Investments in robotics are at an all-time high. Robots investments during 2021 was more than $10B including small scale ventures of say $5M and major efforts such as new SPACs with investments in excess of $4B. In this forum a number of experienced venture capitalists will address the question – what are interesting opportunities on the horizon across manufacturing, services, healthcare, logistics and transportation?.

Panelists

- Petra Hansen, Spring Mountain Capital

- Travis Briggs, ROBO Ventures

- John Lee, Jazz Ventures

- Christopher Moehle, Coal Hill Ventures

- Zach Schildhorn, Lux Capital

Petra Hansen

Spring Mountain Capital

Petra Hansen heads the private equity funds component of SMC’s Private Capital Group and is a member of its Investment Committee. Ms. Hansen joined SMC from HealthpointCapital, LLC, a New York-based private equity firm with over $800 million of assets under management, where she was Director of Marketing. Prior to Healthpoint, Ms. Hansen was an analyst at White Mountains Reinsurance Group, where she helped execute M&A transactions. Most recently, she was an advisor to Newsle, Inc., a social media startup, which LinkedIn acquired in 2014 and is now part of Microsoft. Ms. Hansen began her career as assistant investment officer at Dartmouth College where she was responsible for the management of the College’s private equity portfolio. She received an M.B.A. from the Amos Tuck School at Dartmouth and a B.A. in Economics from UCLA.

Travis Briggs

ROBO Ventures

Travis is CEO and Partner of ROBO Global US. A veteran of the finance and wealth management industry, Travis is responsible for managing daily operations of the firm, executing business strategy and serving on the Index and Classification Committees. Prior to joining ROBO Global in March 2014, Travis served as managing director at Smith Group Asset Management in Dallas, where he created and led the firm’s Private Client Group. Before joining Smith Group, Travis served as Chief Operating Officer and Director of Business Development at Dallas-based hedge-fund Discovery Management. Earlier in his career, Travis was the Director of Investor Relations at Triton Energy and worked as an analyst at Bank of America. ROBO Global Robotics and Automation Index was first to market in August 2013. The Index captures all publicly traded companies across the value chain of robotics, automation and enabling technologies. The Index holds ~80 companies in 15 countries.

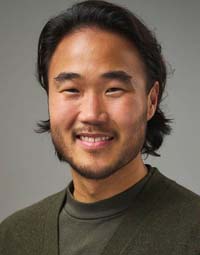

John Lee

Jazz VP

John is a seasoned investor, focusing on companies across frontier technology, enterprise software, robotics, healthcare, and artificial intelligence. He gravitates towards startups that are using science and technology to break down barriers to productivity growth and enable a better future for the largest number of people.

Prior to JAZZ, John was at Osage University Partners (OUP) and Lux Capital, where he focused on building and investing in companies at the intersection of science and deep technology. He brings extensive expertise in understanding nascent technologies and how they translate into product. John holds a BS in Biology from Cornell University. John sits on the boards of several companies in the JAZZ portfolio, including Embodied, Rarebase, Oma Fertility, and Zeitworks.

Christopher Moehle

Coal Hill Ventures

Chris Moehle is a Pittsburgh, Pennsylvania-based entrepreneur who focuses on driving innovative technology development as the head of The Robotics Hub accelerator and venture fund. Emphasizing an agile, value-added approach, Chris Moehle rapidly identifies and invests in companies that are capable of driving disruptive change that benefits society.

Active on the boards of Agility Robotics, Ariel Precision Medicine, and JDV Robotics amongst others, Moehle spends a significant amount of time after investment helping companies reach their full disruptive potential. This can be everything from high level strategy and product design assistance to making sales calls and operational plans.

Zach Schildhorn

Lux Capital

Zack is a Venture Partner at Lux and currently serves as a Board Director for Moment and Pawp, as well as a Board Observer for Statespace. A talented visual storyteller, Zack has been a shepherd of Lux’s brand identity and works closely with founders to help them powerfully communicate complex ideas for customers, partners and investors. Over a 15 year career at Lux, Zack has played a key role in nearly every aspect of the organization’s development. His contributions across investor relations, operations, finance and investing have helped Lux scale from less than $100M to more than $4B in assets under management. Prior to joining Lux, Zack worked as an expedition photographer on the Colorado plateau. He created his own curriculum at Cornell University, which combined materials science and entrepreneurship. He graduated in five years with a BS in engineering and an MBA. He has been a guest speaker at Cornell University, Drexel University, New York University and The University of Pennsylvania.